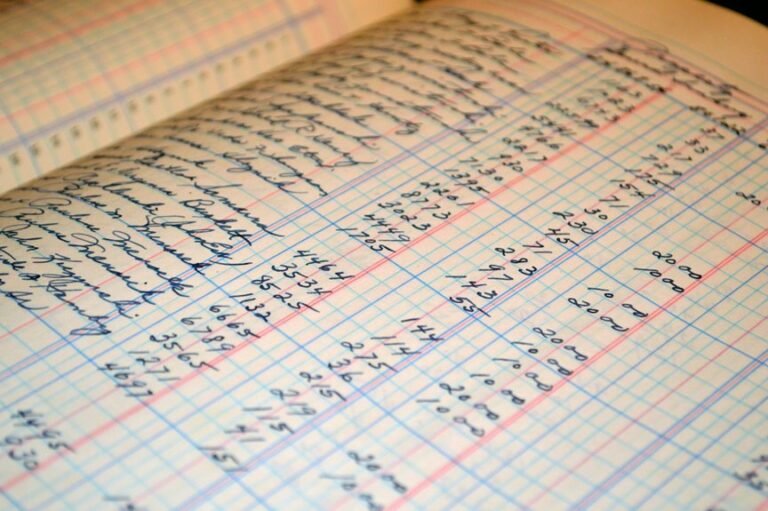

Corporate Activity Ledger on 17056752254, 7446270015, 909011, 8005671083, 2044805071, 692934006

The Corporate Activity Ledger associated with identifiers 17056752254, 7446270015, 909011, 8005671083, 2044805071, and 692934006 is essential for maintaining financial integrity within the organization. Each identifier represents unique transactions that require meticulous documentation. This practice not only ensures compliance with regulations but also enhances decision-making capabilities. However, the implications of effective ledger management extend beyond mere compliance. Exploring these implications reveals deeper insights into the organization’s operational efficiency.

Understanding the Importance of the Corporate Activity Ledger

Although often overlooked, the Corporate Activity Ledger serves as a critical tool for organizations in managing and tracking financial transactions.

It ensures ledger accuracy, which is essential for maintaining financial transparency. By systematically recording all financial activities, the ledger allows organizations to uphold accountability and make informed decisions.

Ultimately, it empowers stakeholders to monitor financial health and foster trust within the organization.

Key Identifiers and Their Significance

Key identifiers in a Corporate Activity Ledger serve as essential markers that facilitate the effective organization and retrieval of financial data.

Their identifier significance lies in enabling precise corporate tracking, ensuring that transactions are easily categorized and accessed.

This systematic approach not only enhances data integrity but also supports strategic decision-making, fostering a transparent and accountable financial environment for stakeholders.

Benefits of Maintaining an Accurate Ledger

Maintaining an accurate ledger is crucial for organizations, as it directly influences financial health and operational efficiency.

It fosters financial transparency, enabling stakeholders to make informed decisions. Additionally, an accurate ledger enhances audit readiness, allowing for smoother evaluations by external parties.

Best Practices for Corporate Record-Keeping

Accurate financial records serve as the foundation for effective corporate record-keeping practices.

Employing robust record-keeping strategies enhances transparency and compliance. Organizations should prioritize digital documentation to streamline processes and ensure easy retrieval.

Regular audits and updates of records further bolster accuracy and reliability. By adhering to these best practices, companies can maintain integrity and foster an environment of accountability, ultimately supporting their operational freedom.

Conclusion

In a world where financial transparency is often overshadowed by creative accounting, the Corporate Activity Ledger stands as a beacon of hope—or perhaps a mirage in the desert of fiscal responsibility. With identifiers like 17056752254 and 7446270015, one might wonder if the true art of record-keeping has become an elusive treasure. Ultimately, while stakeholders bask in the glow of accountability, the ledger remains a silent witness to the ongoing circus of corporate compliance.